Changes in policy climate drive demand of renewable energy

A looming energy crisis began already in late 2020 as a result of disruptions in energy supply. Since early 2022, energy prices have further risen dramatically across Europe as a result of Russia’s invasion of Ukraine, the imposed sanctions, and efforts to reduce dependence on energy imported from Russia.

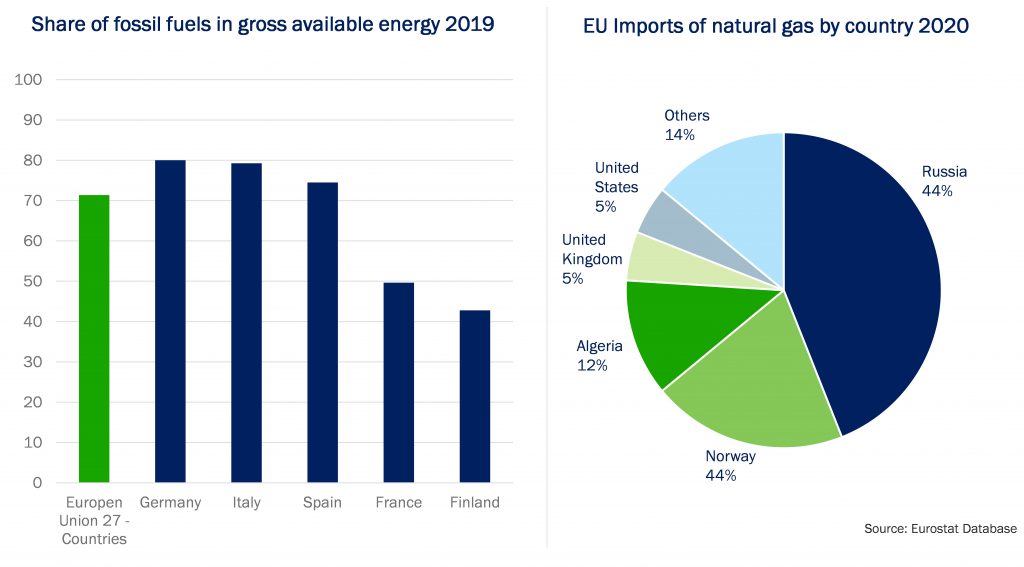

With natural gas prices reaching all-time highs, there is a lot of uncertainty and disruption in the EU’s energy market, which has a big influence on the EU’s economy because it is predominantly reliant on Russian fossil fuels. As gas is a major source of energy in Central Europe, the price of electricity reflects this instantly. In 2020, Russia accounted for 29% of crude oil imports, 44% of natural gas imports, and more than half of solid fossil fuel imports (54%) to Europe.

Figure 1: The share of fossil fuel and EU import of natural gas.

Energy companies have rapidly begun to restructure their own supply chains in order to reduce their dependency on Russia for energy supplies. In addition to the access of sufficient energy, the driving demand of renewable energy should be factored into the investment decision. As a result of the energy crisis, the transformation is accelerating, while European gas consumers seek other solutions to the tripled gas cost.

EU to achieve carbon neutrality by 2050

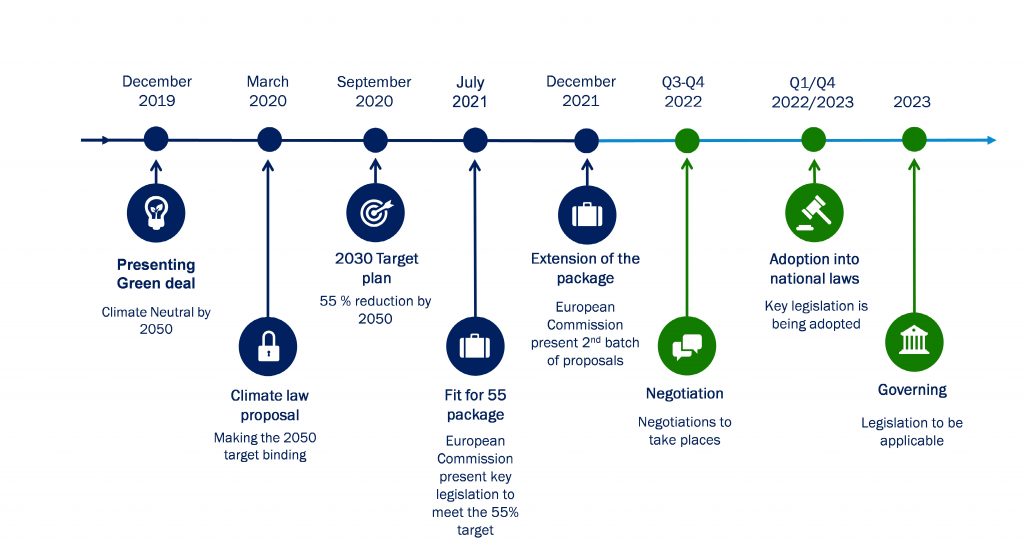

In december 2019, the EU Commission published an ambitious green development program with the goal of reducing fossil fuel dependence, increasing energy self-sufficiency with renewable energy, and decarbonising the EU economy by 2050. This program is driven by the urgency of reducing climate change. As part of Green Deal program project, the EU fit for 55 package was also published.

The EU economy is still largely dependent on fossil fuels. Going forward, the new alternative energy technologies should support the EU Fit for 55 package and strive to secure the energy supply. Because investments in green technology are long-term, these issues should be considered carefully, and energy and material flows should be scrutinised even more closely, as prices will continue to rise in the future when we transition away from fossil fuels.

The goal of the EU Fit for 55 package is to make this change easier by putting in place a long-term plan. To encourage energy self-sufficiency and the growth of sustainable energy, as well as to set long-term goals, major capital investments in low-carbon technology solutions need to be founded on a predictable legislative structure. The package lays out the guidelines and control mechanisms that the EU will use to decrease greenhouse gas emissions in the future. The EU Fit for 55 initiative aims to cut greenhouse gas emissions in 2030 by 55% from 1990 levels.

Although the package expires by 2030, it sets out the guidelines and tools on how the EU will achieve carbon neutrality by 2050. The reform aims to simplify the current complex accounting rules and increase the transparency of monitoring, but the national level implications and legislation are still under development.

Figure 2: The schedule of the Fit for 55 package. Although the package expires by 2030, it sets out the guidelines and tools on how the EU will achieve carbon neutrality by 2050.

Figure 2: The schedule of the Fit for 55 package. Although the package expires by 2030, it sets out the guidelines and tools on how the EU will achieve carbon neutrality by 2050.

The content of the Fit for 55 packages

The content of the Fit for 55 packages can be divided according to the type of legislation act.

The packages affects greenhouse gas emissions, clean energy, and transportation by pricing, targeting, and regulating these activities, resulting in long-term repercussions on all industries.

Figure 3: The content of the Fit for 55 packages can be divided according to the type of legislation act.

The Eu 55 packages aim to support the EU’s energy policy goals by diversifying Europe’s energy sources and reducing reliance on energy imports. It ensures that the internal energy market operates without technological or regulatory impediments. It also seeks to encourage research into low-carbon and clean energy technologies, which will aid in the transition to a low-carbon economy in compliance with the Paris Agreement.

Entry ticket to play

To achieve significant competitive advantage, companies should start to steer their production toward more decarbonised and climate neutral processes. Energy and material flows should be viewed holistically in these low carbon solutions, so that energy and materials are used as efficiently as possible across industry borders, functioning in ecosystems.

Firstly, companies need to create an understanding of their overall energy balance considering all energy and material flows. Secondly, they need to optimise their energy balance and capitalize the value creation potential.

Ecosystem wide cooperation reveals synergies and opportunities, energy and resource flows between users and producers and lead to reducing waste, energy and resources reaching better cost efficiency. Efficient utilisation of resources and energy between different companies opens new innovative solutions and opportunities. To successfully implement a circular economy, all material flows within a value chain must be considered. According to the cascade principle, one fundamental principle is that the side and waste streams are fully utilised.

Figure 4: Future material scenarios

Figure 4: Future material scenarios

Examples of industrial sector integration include new ways of producing and using hydrogen, using carbon dioxide to manufacture products, and new bio- and circular economy solutions linked to clean energy. The upcoming regulatory changes will further increase the already high prices and volatility of fossil fuels and its derived products and will drive investments into solutions that reduce the utilisation of fossil fuel. This creates new possible product solutions for the industry.

Incentives are needed to accelerate transformation

Financial justification for environmental performance investments is challenging because investments do not always have a direct payback. Funding and incentives for private investment will also play a big role in the implementation of new technology and deployment of clean energy. Regulations related to sustainable finance have increased significantly in the EU since 2018. The goal is to support the green transition and allocate private capital to sustainable economic activities, therefore supported initiatives must demonstrate how they will contribute to a low-carbon solution. The more the funded project is able to demonstrate reduced emissions and efficient utilisation of resources, the better it will obtain support and funding for the project.

The goal is to fund research and demonstration projects that accelerate the development of ideas from laboratory to the proven concept, and successful products and services that enable companies’ sustainable growth with a positive social impact. There exist multiple different funding programs that can be divided into grants and market-based products.

In addition to funding and grants, alternative financing tools can be used to enable green investments. Many companies have issued green bonds to finance their own green transition e.g.examples from Finland are Fingrid, Stora Enso and UPM.

The green bond market is still expected to multiply as more companies will supplement their financing with green bonds.

Regulatory changes will affect the operating environment

It is vital to understand the impacts of regulatory changes and control mechanisms on the company’s business and prioritise the potential effects on the company’s own operating environment.

Figure 5. Examples of the ongoing funding programmes of EU

Companies that begin to steer their production toward more decarbonised and climate-neutral processes will gain a competitive advantage over their competitors.

It is necessary to develop technologies and processes that accelerate the transition into a circular economy and produce more with less. Providing cost-effective solution in the future will eventually be an entry ticket to play.

The Fit for 55 package includes:

Emission Trading System (ETS) is a market-based system in which the maximum amount of emissions at the EU level is defined and distributed to the emission production facilities of EU member states. Producing facilities can buy or sell ETS permits depending on the generated emissions. In the upcoming reform the annual emission permits will be tightened and expand to to cover traffic and heating of buildings. Previously it has been applied only to heavy production and industry. EU may potentially also set a minimum price for CO2.

Energy Taxation Directive (ETD) encourages cleaner energy methods and environmentally friendly energy sources? by taxing the most polluting fuels (coal, oil, gas). There is no distinction in the ETD between the types of end-use of fuels and electricity, whether for industrial or household usage. ETD will be adjusted annually and will be based on Eurostat consumer price figures.

Carbon Border Adjustment Mechanism (CBAM) is a new legislation, which will prevent carbon leakage from the EU. CBAM will increase the price of specific products and utilities, such as steel and electricity, if it is imported from countries with a less strict climate policy than in the EU. The target is therefore to support the competitiveness of the EU’s own production. It also encourages countries outside of EU to develop their climate regulation and emissions pricing systems

Effort Sharing Regulation (ESR) sets binding annual greenhouse gas emission targets for sectors that are not covered in the EU emissions trading scheme or the regulation on land use, land use change and forestry (LULUCF), for instance agriculture or heating of buildings. Each EU country has its own target that is based on their gross national income.

Energy Efficiency Directive (EED) tightens EU’s primary energy consumption reduction target from 39% to 41% by 2030. The aim is to promote resource efficiency, circular economy, and competitiveness. The Commission presents regulations on public procurement, the wider introduction of energy audits, the extension of the annual renovation rate target to all public buildings, heating and cooling, and waste heat recovery.

Renewable Energy Directive (RED III) increases the share of renewable energy in the entire EU’s energy consumption to 38‒40% by 2030 by setting sub-goals for the transport sector, the heating and cooling sector and industry. However, there are no national binding goals being set yet.

Land Use and Forestry Sector (LULUCF) ensures that no emissions are generated from the land use sector in the period 2021–2030. Emissions must be compensated by at least an equivalent number of removals. Increase natural carbon sinks throughout the EU and also take EU’s biodiversity strategy into account.

CO2 standards will tighten the emission limits for new passenger cars. The proposal is to promote the electrification of traffic in Europe and support member states in reaching their national targets.

ReFuelEU aviation includes the renewable aviation fuel blending obligation for aviation fuel distributors and the renewable aviation fuel usage obligation for airlines. The goal of the proposal is to end the growth of air transport emissions and to promote circular transition.

FuelEU Maritime requires that the share of renewable and low-carbon fuels in maritime transport be gradually increased between 2025 and 2050. At first this means mainly mixing biofuel with fossil fuel and in the longer term switching to emission-free fuels or power sources.

Infrastructure package aims to speed up alternative fuel vehicles for charging or refueling and provide alternative power sources. Binding targets for alternative fuels; electric vehicle charging points, hydrogen refuelling points, aircraft at airports and on-shore power supply or LNG refuelling points in maritime ports.

On the author: Jussi Räsänen, Consultant. Jussi holds a MsC in Chemical Engineering and has a background as senior process engineer. He has a strong interest in bio-based materials and new energy solutions.

Vision Hunters provides strategic advisory services for the forest and bio-based industries, and energy sectors. We assist leadership teams in making the smartest strategic choices to improve the outcome of their company in the future. We are highly experienced and result-oriented and have advised many of the leading companies in our industry.