From Forest to Flight: The role of forest industry companies in future biofuel market

The biofuel industry faces a critical challenge as it navigates the changing landscape of transportation fuels. Despite the increasing demand for biofuels, especially in road traffic with passenger cars, there is a risk that biodiesel and bioethanol might serve merely as transitional fuels until full electrification of the vehicle fleet. Additionally, many European nations have recently announced the loosening of distribution obligations, aiming to support consumers amidst economic turbulence.

Amidst these dynamics, the biofuel industry is engaged in an upbeat discussion around sustainable aviation fuels (SAF) and their potential to dominate the biofuel market in the future. One prominent example is Neste, a leading company in biofuel production, which estimates that by 2030, the annual demand for SAF will reach ten million metric tons1. This projection represents a nearly 70-fold increase compared to the current demand. However, even with this ambitious estimation, it is approximated that achieving international net zero targets by 2050 would necessitate an additional 8 million metric tons of demand in 20302. What is the role of the forest industry in this equation? Could collaborative efforts between the forest industry and biofuel sectors address the widely acknowledged challenge of feedstock availability?

The Great Challenge: Navigating feedstock availability for advanced biofuels

However, there are several key considerations that need to be addressed to approach these figures, particularly regarding regulation and distribution of advanced biofuels. In addition to the challenges mentioned earlier, one of the primary obstacles hindering the wider adoption of biofuels relates to feedstocks. Many biofuel companies are actively searching for new raw materials to serve as feedstocks for advanced biofuels. Apart from developing the necessary technological expertise to convert feedstocks into usable fuels, these companies must also ensure a reliable and sufficient supply of raw materials, integrating them effectively into their value chains. Hence, in the near future, the competitive advantage of biofuel companies will be rooted in their feedstock capabilities. Recognising the widespread challenge of feedstock availability, biofuel producers face significant risks in relying on a single feedstock type.

Although residues from forest industry have already been recognized as potential feedstocks for SAF generation, many competing alternatives exist.

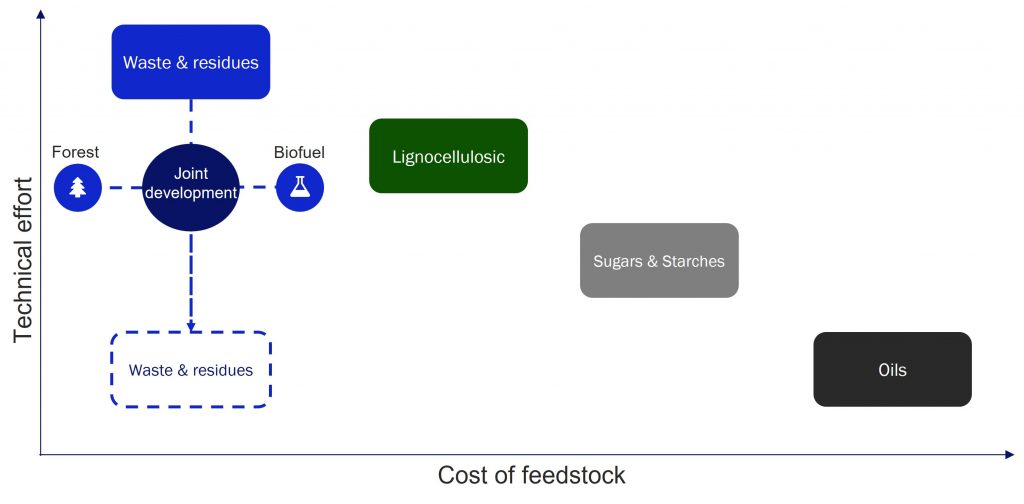

As presented in Figure 1, according to International Civil Aviation Organization (ICAO), technical efforts required to convert waste and residues to SAF are significantly larger compared to oil-based, sugar, and starch feedstocks3. On the other hand, due to the simplicity of conversion technology, oil-based, such as used cooking oil, feedstocks are more expensive compared to waste and residues. Acknowledging this trade-off, from the perspective of forest industry companies, it is illogical to relinquish their current financially feasible and technologically proven end uses for the residues and hand over the value-adding activities to other players in the sandbox.

Figure 1: Technical conversion efforts and costs by feedstock type3

Solutions from collaboration: Closing the gap between low feedstock prices and high technology costs

Since the SAF industry has a significant forecasted growth, investing in biofuels could provide a tempting opportunity for companies operating in the forest industry. However, developing technological conversion capabilities requires extensive investments, and from the existing 34 European SAF projects (either in operation, planned or in construction) only a couple are initiated by traditional forest industry companies3.

In addition to the technological capabilities, the forest industry companies need to figure out how to establish efficient relationships with downstream stakeholders in aviation fuels’ value chain.

Could this equation reveal prospects for future collaborative models between the forest and biofuel industries? Leveraging from each other’s know-how, biofuel companies could secure sufficient and steady feedstock flow and develop the conversion technology with joint risk. For forest industry companies, benefits include acquiring knowledge on jet fuel distribution, and perhaps more importantly, establishing new revenue streams in a situation where pulp and paper prices are extremely volatile. As presented in Figure 1, such collaborative model should aim for reducing the required technical efforts for converting forest residues to SAF while maintaining the low feedstock prices of wood-processing waste and residues. If this is successfully achieved, the companies can have a significant competitive edge in the future.

SOURCES:

[1] Kauppalehti

[2] IATA

[3] ICAO

About us: Vision Hunters offers strategic advisory services for the forest and bio-based industries. Our expertise spans the entire value chain from forests to final products and side-stream businesses. Our offering includes tailored strategic analyses, investment opportunities, business assessments and operations improvements. With in-depth knowledge and industry vision, we tailor implementable pragmatic solutions to support our clients in the sustainable transition.

See our bioproducts capabilities.

Quick link to further Read Our Thinking insights

What is Sustainable Aviation Fuel?

Sustainable Aviation Fuel, SAF, is a liquid fuel currently used in commercial aviation which reduces CO2 emissions by up to 80%. It can be produced from a number of sources (feedstock) including waste oil and fats, green and municipal waste and non-food crops. Whereas fossil fuels add to the overall level of CO2 by emitting carbon that had been previously locked away, SAF recycles the CO2 which has been absorbed by the biomass used in the feedstock during the course of its life.

Seven biofuel production pathways are certified to produce SAF, which perform at operationally equivalent levels to Jet A1 fuel. By design, these SAFs are drop-in solutions, which can be directly blended into existing fuel infrastructure at airports and are fully compatible with modern aircrafts. (Source: IATA)