Paper vs Plastics: Navigating Turbulent Waters in the Packaging Industry

Packaging markets have experienced unprecedented volatility in recent years, with paper and board manufacturers facing surging demand during COVID-19, followed by both an energy crisis and a de-stocking effect, resulting in a very challenging year in 2023. However, as we go into the second half of 2024, markets are showing signs of recovery, and an increasing number of paper and board manufacturers are revealing optimistic demand outlooks.

The challenge

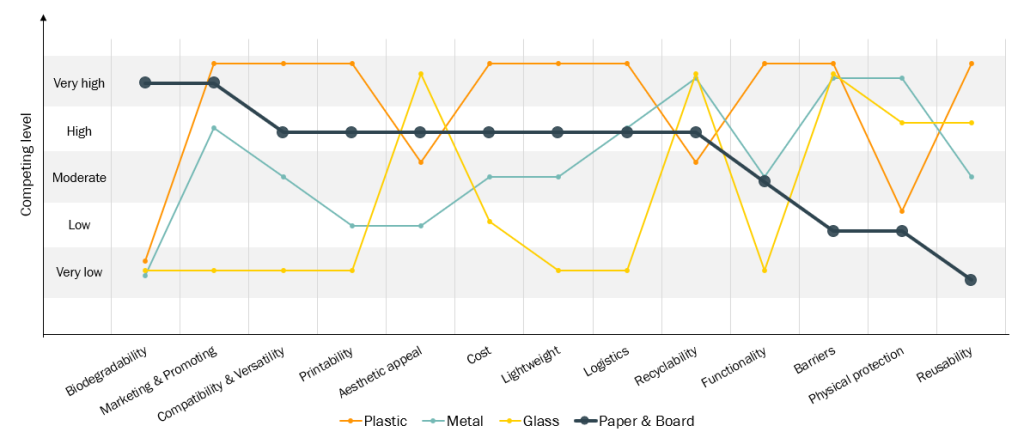

Despite improving market conditions, there are still uncertainties regarding paper and board packaging. Some stakeholders, such as regulators and NGOs, are questioning the use of forests as a raw material, and cost pressure is always present, particularly among Western producers. In the future, biogenic CO2, closed-loop recyclability, and reusability will further increase the complexity in defining what is considered as a sustainable packaging solution. Furthermore, paper and board are typically not the best options for many applications, as they often do not have the optimal properties that downstream stakeholders, such as converters, brand owners, and consumers, are looking for.

Comparative performance of packaging materials across various properties

Source: Vision Hunters

Balancing biodegradability and industry challenges

Although paper and board are the most viable biodegradable options when uncoated or with a bio-based coating, plastics outperform many of the associated packaging properties, such as reusability, lightness, barriers, and cost, which are critical in many applications. In addition to quality and cost advantages, the petrochemical industry as a whole poses a threat to fibre-based packaging and paper & board manufacturers in terms of lobbying power and CAPEX spending. For example, in 2022, the aggregated CAPEX spending of the pulp and paper industry was around $ 80 billion, while the combined CAPEX spending of oil and gas producers was nearly $500 billion.

The high combined CAPEX of the petrochemical industry also includes investments in conventional oil and gas operations. Yet many industry stakeholders are allocating capital and resources to more sustainable practices, such as fossil-free and recycled plastics, recycling infrastructure, waste stream integration, green hydrogen, and CO2 capture and storage. If these investments are both successful and scalable, they will help to increase the sustainability of petrochemical industry. Despite the initiatives, plastics have yet to catch up with paper and board in terms of circularity.

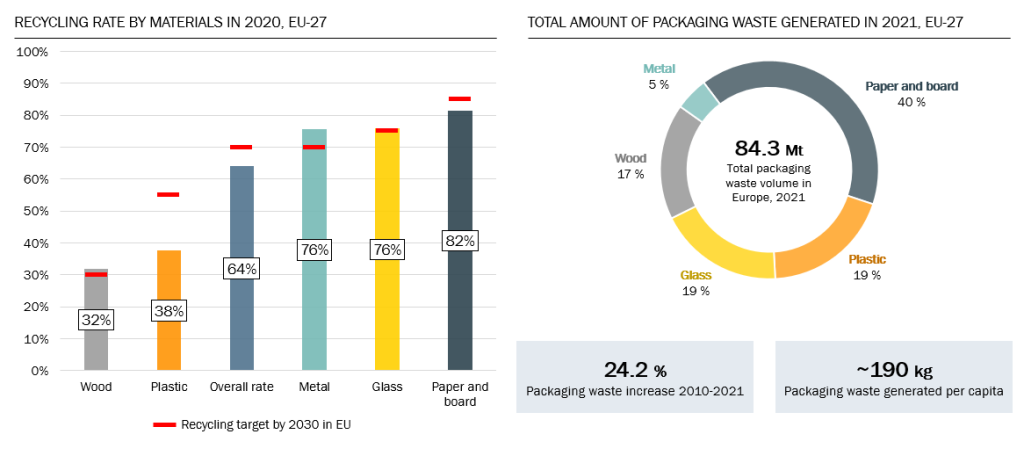

Packaging waste & recycling statistics in Europe

Navigating recycling success and market challenges

In Europe, more than 80% of paper and board packaging materials are already recycled, whereas plastic recycling rates are less than 40% (Source Eurostats). Furthermore, in recycled containerboard and cartonboard grades, a closed loop is fully achieved. On the other hand, paper and board are the most common sources of packaging waste, and regulatory focus has recently shifted to reusability. If downstream stakeholders in the value chain, such as converters, retailers, and consumers, adopt the reusability concept on a large scale, there is a risk that the long-discussed substitution mechanisms will turn against fiber-based packaging.

In addition to the previously discussed concerns, excessive investments and oversupply pose challenges for paper and board manufacturers. For example, massive and cost-competitive volumes of folding boxboard (FBB) and Chinese ivoryboard from Southeast Asia tightened the global folding carton market in 2023. Although the ESG and CSR efforts and performance of Western producers remain undeniable, emerging economies are increasingly focusing on improving the overall sustainability of their operations, with certifications such as FSC and PEFC becoming more widely used. Despite the significant quality advantages of softwood fibers in paper and board packaging applications, many manufacturers have already begun optimising their supply chains to leverage cost-competitive Latin American eucalyptus fibers.

Steering recycling success and market challenges

Given the challenges presented by fibre-based packaging, paper and board packaging material manufacturers need to regain momentum by reinventing business models and leveraging their position as the most sustainable heavy industry.

Redefining focus markets and client segments, establishing competitive advantages, developing a clear asset strategy, and considering integration and growth opportunities can all be extremely beneficial in determining one’s position in the packaging industry and value chain.

Products in the paper and board packaging industry are relatively homogeneous, making product differentiation difficult. On the other hand, having a suitable raw material base can aid in achieving quality leadership, which is necessary in heavy-duty, luxurious, and other more demanding applications. Regardless, packaging is a commodity-driven market that relies heavily on cost competitiveness. Therefore, paper and board manufacturers must develop a structured strategy for asset management and CAPEX allocation to reduce OPEX while increasing operational excellence.

However, due to rising fibre costs, European and other Western producers are finding it increasingly difficult to compete with Asian and Latin American volumes. Because competing in the cost leadership competition is not always feasible, manufacturers must devote resources to commercial excellence to define the markets, value chains, and end-uses in which they want to operate and how to achieve profitable growth.

Succeeding in a global marketplace

As evidenced by the merger of Smurfit Kappa and WestRock, as well as International Paper’s potential acquisition of DS Smith, economic downturns can be advantageous times to capture market share through M&A activities. Beyond bolstering core operations, companies may find value in vertical integration along the downstream value chain. In actuality, the level of integration varies significantly across regions and packaging grades.

For example, in North America, the largest cartonboard manufacturers are also involved in converting, whereas European suppliers are primarily focused on producing paper and board, and the European folding carton converting scheme is far more fragmented than in North America.

When analysing growth opportunities, downstream integration should not be overlooked, as it can reveal many promising alternatives, such as new and innovative business models and joint ventures.

To summarise, thriving and achieving sustainable growth in the relatively stable and modestly growing packaging industry requires operational and commercial excellence, smart capital allocation, and consideration of both horizontal and vertical integration opportunities.

About us: Vision Hunters offers extensive expertise in the paper, paperboard, and packaging sectors, with deep experience across the entire lifecycle and value chain. We understand the evolving business environment—from recycling standards and novel coating materials to the drivers behind plastic substitution. Our insights help make sustainable business decisions that foster growth and create value. As the trusted advisor of many leading companies in this industry, Vision Hunters navigates the complex development matrix of kraft and specialty papers, ensuring optimal conversion strategies and perfect alignment with product, brand, and market needs.

Further Read our Thinking articles.