Understanding Europe’s Forests and Their 16 million Owners

Europe holds thirty-five billion cubic meters of forest owned by public entities, private companies, and individuals. The ownership structure and motivation for forest management varies within the continent. Economic, social, and environmental values of the owners, property size, location and infrastructure define how the forest estates are valued and treated. It is crucial to understand the motivations of different owners amidst the pressure of two-way requirements; To increase biomass supply in Europe and preserve forest habitats.

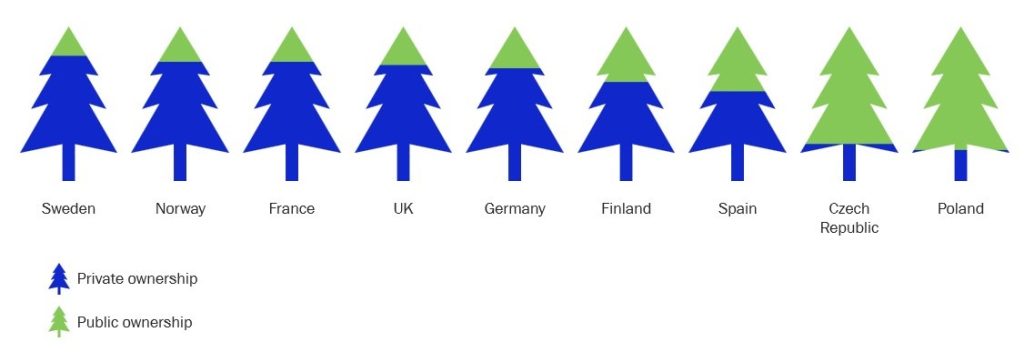

Private ownership dominates in Northern and Western Europe varying from over 90% in Sweden to 50% in Ireland. Public ownership is more typical in Eastern European countries. For example, private ownership accounts for one fifth in Poland and one fourth in Czech Republic. In contrast to privately owned forests, which have more varied incentives ranging from purely financial to altruistic, publicly owned forests frequently place an emphasis on social and political aspects.

Europe’s heterogeneous forest ownership structure

Source: National statistics and public sources

Restricted accessibility to the green reserve

Forest is a stable asset class and increases its attractiveness as an investment, especially in times of market turbulence. Forests grow regardless of financial cycles, even though the deal activity in forest estates varies with economic cycles. The ownership structure has an impact on forest accessibility. Typical hurdles for acquiring forest estates in European countries are related to cultural and regulatory aspects. In countries where public forest ownership dominates, the law may restrict the access of foreign investors to forest estates. In countries where private, family-oriented ownership dominates, cultural aspects may limit the willingness to sell forest outside the family.

Breaking barriers: Navigating Europe’s forest ownership challenges

Some countries utilise investment funds to promote innovative, new forest ownership models. For example, Portugal, where forest ownership is mostly private, is pursuing more professional ownership in order to halt the fragmentation of forest plots, to establish efficient forestry management practices, and to bring innovation to the sector. Funds and private forest management companies are also present in Ireland, where a state-owned company manages half of the forests.

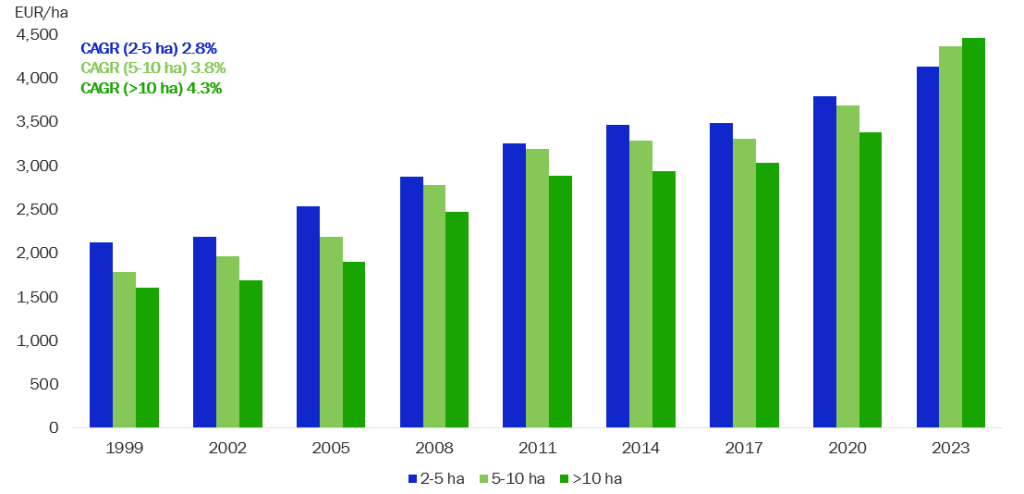

The growing share of investors puts pressures on forest land prices. For example, in Finland, where the share of funds as a form of forest ownership is rapidly increasing, forest estate prices have seen a steep upward trend. Especially large estates over ten hectares have faced a price spike since 2020.

Median prices of Finnish forest estates have been steadily increasing since 1999

Source: National Land Survey of Finland

Influence correlates with size

Simultaneously, the rising energy prices and increased competition of biomass have tightened due to targets related to carbon sinks and CO2 reduction. Large, privately owned companies are increasingly participating in voluntary offset schemes. For example, Stora Enso is piloting a novel biodiversity service featuring a premium paid for forest owners, when they adopt sustainable forest management practices. Ingka of IKEA has acquired over 250,000 hectares of protected forests to combat deforestation. St1 is conducting a carbon farming scheme in Europe, where it aims to discover ways to maintain and increase organic carbon stocks.

Private forest owners can join their forces and opt for joining their forest assets to community forests, where the forest management is frequently handled professionally.

Community forests are suitable especially for forest owners who do not have the urge to participate in forestry work or decide on timber sales themselves. When forests are managed as larger units, the price for wood is generally higher and the forest management cost lower. Larger areas also increase the opportunities for conservation and recreation. Heterogeneous forest ownership diversifies land use and silvicultural practices across the European green mosaic, whereas a too fragmented ownership base diminishes the opportunity to make an impact.

*******

Vision Hunters’ works in the core of the bioeconomy advising companies on nature-based solutions. Our sourcing know-how encompasses traditional forest assets, but increasingly also non-wood raw materials such as agrowaste and non-fossil sidestreams from different industrial processes. For further information, please contact: Iris Ollilla, Mangaging Director.

About us: We help our clients in the transition to a fossil-free future. Vision Hunters offers strategic advisory services for the forest and bio-based industries. Our expertise spans the entire value chain from forests to final products and side-stream businesses. Our offering includes tailored strategic analyses, investment opportunities, business assessments and operations improvements. With in-depth knowledge and industry vision, we tailor implementable pragmatic solutions to support our clients in the sustainable transition.